This is the top of the main content

2. Looking forward – Technologies driving change

We wish to understand the technology trends driving change in New Zealand and their potential to support digital transformation, while achieving effective and efficient use of spectrum as well as policy and regulatory objectives.

On this page

Each generation of technology brings its challenges. Technological advancements in radiocommunications are no different. The speed of development means regulators, industry and consumers have to constantly navigate a range of complex technological matters. As industry and consumers adapt, regulators need flexibility to respond.

The roll-out of 5G networks worldwide is underway and is an example of a new wave of technological development which will continue to grow and evolve to 6G, which is expected towards the end of this decade. The ongoing development of satellite technologies providing more ubiquitous connectivity and broadband is an example of a new wave technological development. Another example is the miniaturisation of devices and equipment, along with the development of internet of things and private networks. New technologies will create an environment of digital transformation that will influence many industries and will continue to challenge the way we think about radio spectrum management.

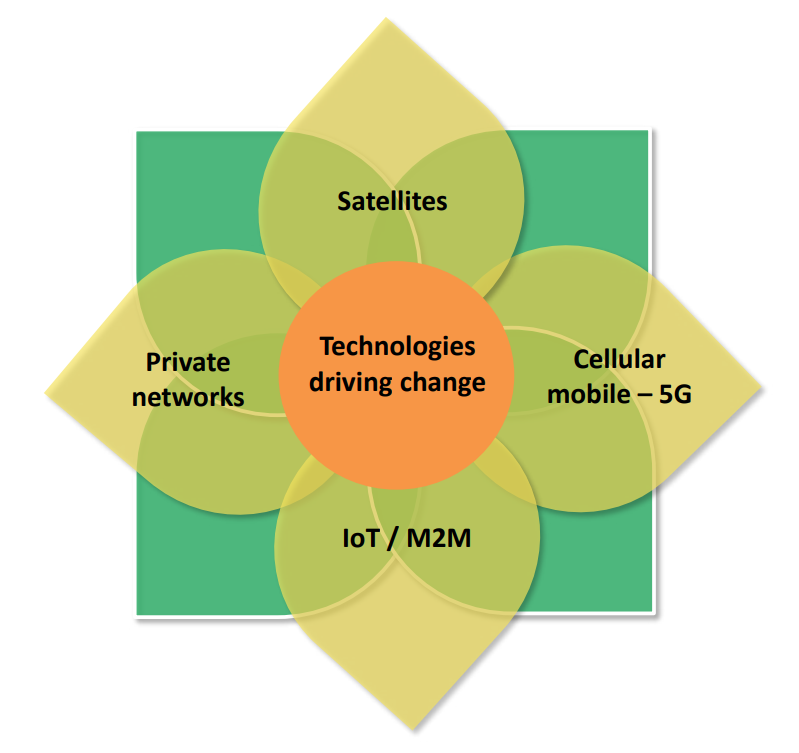

In this section, we comment on 4 key trends as shown in figure 2:

- satellites

- cellular mobile – 5G

- internet of things (IoT)/Machine-to-Machine (M2M).

- private networks.

2.1 Satellites and space – evolving technologies and use cases

In the last decade or so there has been significant investment by governments and the private sector in the space industry which has stimulated development of new satellite technologies.

These developments relate to size, function, payload capacity, power storage and launching. This has enabled a degree of mass production that has driven down the price of satellites, and vastly reduced the cost of launching, further pushing technological advancement.

We are seeing the results of these investments through the emergence of new Low-Earth-Orbit (LEO) satellites, mega satellite constellations, low-latency satellite networks, short duration satellites and further development of existing satellite networks. We have seen increased delivery of satellite broadband services to the New Zealand consumer in recent years. We have also seen new use cases emerge such as Non Terrestrial Networks (NTN), Direct to Device, IoT and sensor networks.

The success of new satellite technologies and the relative explosion of satellite projects is putting pressure on the international frequency coordination regime. It is also influencing application and uptake in non-space sectors. This is stimulating interest in new use cases that satellites can support, such as more ubiquitous connectivity and consumer broadband, particularly to locations not currently well served by traditional service providers (for example, rural and remote areas).

These new use cases are challenging traditional business models. For example, it could be necessary to adapt international regulation of satellites to capture these new use cases and to address technical, commercial and regulatory considerations. This would also ensure that international regulation does not constrain the development of new use cases.

Example: Mega satellite constellations and satellite broadband

LEO satellites converged into low-latency satellite networks can provide consumer broadband using phased array antennas and a significant network of ground stations.

These low-latency networks are powered by large constellations of LEO satellites. Phased array antennas can be steered electronically to track these satellites, even while moving.

This means they can be placed on an aircraft, marine vessels or automobiles, as well as covering areas that are not economically viable to cover with terrestrial infrastructure.

These networks have many more LEO satellites in a constellation than you would need geostationary satellites (for example, tens of thousands versus less than 6).

Implications for New Zealand

Our strategic advantage in the space industry includes our location for launch sites, and for tracking, telemetry and control (TT&C), and earth station facilities in the southern pacific. This has stimulated a domestic space economy around the launching of small satellites and increased TT&C and Earth Station facilities. It has also stimulated further investment into the New Zealand space sector. In turn, growth in the space sector increases the volume of ITU-R satellite filings, coordination requests, notifications and recordings in the master international frequency register as well as increasing the co-existence considerations Radio Spectrum Management (RSM) is responsible for the administration of satellite filings submitted to the ITU-R on behalf of New Zealand businesses. RSM expects to continue processing filings, coordination requests, notifications, and registrations in the space service bands.

In light of the rapid technological development and the range of satellite services available to industry and consumers, our regulatory responses will need to take into account changing market dynamics. New Zealand’s Space economy is ‘New Space’ driven, characterised by a mix of start-up and well-established, small and large entrepreneur-driven and privately funded space companies that service both government and non-government customers. This is in contrast to ‘Traditional Space’ economies where large-scale government activity has been a major driver (such as in US and Europe). International space economies are now expanding from Traditional Space models and developing their New Space activities.

RSM will continue to monitor developments in satellite technology and use of new satellite bands (including developments on telemetry, short messaging, low-data-rate IoT satellites, Non Terrestrial Networks and Direct to Device) and evolving market structures. Satellite technologies may support future connectivity work programs which seek to ensure that New Zealand continues to have world standard connectivity to meet the current and future needs of New Zealand’s businesses and people.

We will also continue to assist the NZ Space Agency on issues as they arise and provide information on regulatory settings for satellite operators.

Upcoming projects

- Progress work on the future use of the 24 - 30 GHz frequency band.

- Consider 1980 - 2010 MHz and 2170 - 2200 MHz S band and 40/50 GHz QV band.

- Monitor MSS developments in 1518 - 1525 MHz and E band Satellite systems in 70 /80 GHz.

2.2 Growth in wireless broadband traffic

One of the most significant trends of the last decade is the uptake and growth of fixed wireless and mobile broadband. With a growing range of new mobile applications and services, there has been a dramatic increase in mobile data use. The drivers behind this growth are video usage, device proliferation and application uptake, along with the emergence of higher definition video (4-8K) and virtual reality. The growing use of applications to stream content is particularly noteworthy.

The trends that are expected to increase overall mobile telecommunications traffic over the next decade are shown in figure 3:

- accelerated deployment of new IMT technologies

- growth of M2M applications

- cloud computing

- fixed broadband replacing mobile broadband solutions

- subscriber behaviour

- asymmetric traffic

- evolution in usage/traffic characteristics

- shifting demography: urbanisation trends

- deployment timescale

- proliferation of ambient screens and enhanced screen resolution.

Source: ITU Report M.2370-0 (July 2015)

Internationally, the radiocommunications industry is adapting to this growing demand in different ways. New and innovative types of technology are being developed to help manage this demand and allow the uptake of new use-cases from different types of service providers. Services such as fixed wireless and mobile broadband are now part of a wider package that also includes other capabilities. Use cases like internet of things (IoT), ultra-reliable services, ultra-low latency and customised networks provide services tailored to customer requirements.

The member states of the International Telecommunications Union (ITU) have achieved agreements in the last 2 decades on international allocations and identifications to support the development of mobile broadband. The last 3 World Radiocommunication Conferences (WRC-12, 15 and 19) have focused on addressing growing mobile broadband access requirements through the harmonised identifications of spectrum for International Mobile Telecommunications (IMT). IMT, IMT-Advanced and IMT-2020 are the ITU-defined technical requirements to be met by 3G, 4G and 5G mobile broadband equipment.

Various wireless technologies, including 5G and 6G in the future, are likely to demonstrate growth in parallel to traditional service providers and network operators. Businesses and sectors which might not typically invest in IMT infrastructure may look to build their own networks to provide services that are customised to their needs. In many countries where spectrum has become scarce, this is also driving interest in spectrum sharing models including more advanced methods such as dynamic spectrum access.

Implications for New Zealand

The challenge we face is finding ways to make spectrum available in key bands to accommodate new wireless applications while maximising growth and investment in these services.

Spectrum allocations have formed the basis for developing mobile data networks including for 5G (IMT-2020) and in the future 6G (IMT-2030). However, spectrum identified for IMT at an ITU level, almost always has incumbent users. With potential increases in spectrum users and service providers, RSM will need to actively manage challenges such as sharing, compatibility and user conflicts. We will need to work with the sector to create a positive investment environment for mobile infrastructure and services.

We are seeking ways to support the roll-out of 5G services alongside other broadband technologies and in the future 6G services. By enabling these technologies, we aim to support increasing broadband connectivity through offering a greater range of options by which greater rural capacity and coverage can be provided, as well as supporting an increase in innovation and productivity in urban areas.

While there has been a focus to enhance coverage and connectivity, the emphasis will increasingly shift to:

- addressing capacity constraints, including ensuring there is sufficient capacity to cater for future growth

- supporting different use cases (for example for industry verticals), developing capacity, and enabling uptake of new wireless technologies including addressing interoperability needs.

RSM will continue to proactively engage in the WRC, ITU, APT and international matters relating to spectrum, including monitoring and responding to developments. RSM will also monitor developments in new emerging 6G mobile technology and standards, particularly relating to use cases, spectrum sharing, and tiered and dynamic access mechanisms.

Upcoming projects

- Consider: 600 MHz, 1980 - 2010 MHz, 2170 - 2200 MHz, 3.34 - 3.4 GHz, 3.4 - 3.46 GHz, 3.8 - 4.2 GHz, 6.425 - 7.125 GHz, 24 - 30 GHz, and 40 GHz bands for 5G / 6G and associated technologies.

- Monitor 1427 - 1518 MHz and 5.925 - 6.425 GHz.

2.3 Massive internet of things

The global growth in connectivity (also driven by global broadband uptake) has encouraged the development of wireless applications for enabling the automated and seamless day-to-day interaction between machines, portable devices, objects, infrastructure and people. These applications range from personal wearable devices such as tracking bands, to automated smart homes, assisted transportation systems and in targeted systems in a 'smart city'. A common thread between these use cases is they revolve around large numbers of devices sending low amounts of data.

Internet of Things (IoT) is a concept for internet connectivity of objects, devices, appliances and sensors. The definition of IoT is still evolving, but it is widely understood as an application integrating multiple existing technologies rather than a class of radiocommunication technology. The types of applications and purpose vary widely, and the connectivity aspect of these emerging wireless applications does not point to any specific spectrum band as a sole access solution.

Machine-to-Machine (M2M) applications are widely used for transmitting low bit-rate data between devices and systems.

Use cases for IoT and M2M wireless applications will develop rapidly with the roll out of other wireless technology like 5G services, development of 6G, satellite connectivity and generally authorised short-range devices (for example, the increasing connectivity of agricultural machinery for operation and monitoring). The potential of IoT and M2M for health and safety monitoring and sustainability measures has also been widely researched but is yet to be implemented at scale.

The standardisation of wireless technology is creating a trend of convergence around wireless 3GPP and IEEE standardised technologies to replace proprietary technologies and land mobile systems in some sectors.

Implications for New Zealand

IoT and M2M wireless applications operate currently across generally authorised or licenced spectrum (also known as licence-exempt or unlicensed) as well as licenced mobile spectrum, for example, 5G NR and 4G LTE, allowing commercial mobile carriers to offer dedicated bandwidth and coverage to M2M and IoT customers.

We are now seeing IoT use cases in industry and domestically for gathering data, monitoring and reporting (utilities monitoring smart meters for example). Having a coherent system for applications in a particular sector (for example, utilities) provides for economies of scale and interoperability of devices nationally.

RSM will continue to monitor IoT business models and use-cases internationally. Many of these business models are integrating IoT with private networks and spectrum sharing to provide customised services that use spectrum efficiently. The extent to which the Radiocommunications Act 1989, and other legislation might form barriers to the development of these business models is an ongoing focus.

RSM will also monitor the need for spectrum for critical infrastructure in New Zealand (see the ‘Smart transport in New Zealand’ example on this page).

Upcoming projects

- Review and re-plan appropriate spectrum bands, including technical consultation.

- Scope issues and develop proposals to modernise the administration of the Radiocommunications Act 1989 to keep pace with new technologies and market developments.

Example: Smart transport in New Zealand

Transportation systems are becoming increasingly reliant on wireless connections for essential safety applications to operate. The absence of, or interference to, wireless connections will render some systems inoperable. KiwiRail has systems deployed in Auckland that are capable of running increased safety and signalling features if they have radios connected between the electric train fleet and trackside infrastructure. For its Wellington metro operations, KiwiRail is at the start of a multi-year business case process to procure a new signalling system for the metro network, to enhance its capacity.

In other countries, dedicated ranges of spectrum have been set aside for rail applications. In New Zealand, we have a number of land mobile channels for rail use (typically 12.5 or 25 KHz wide). However, the newer systems available employ LTE-based technologies, with bandwidth requirements of 3-5MHz. This is a large increase in the spectrum required. This also reflects the increasing trend of the broader radio sector to move towards standardised cellular based systems. The Government Policy Statement has set aside 1900-1910 MHz for potential rail use pending a business case by KiwiRail.

2.4 Private networks and industry verticals

There has been increased interest in private wireless networks for different industry sectors like manufacturing, agriculture, and logistics, often referred to as ‘verticals’. In general the idea is to improve connectivity for these industries which will lead to greater productivity gains from automation in industrial practices ('Industry 4.0'). While use cases for verticals do not exclusively use mobile spectrum, there are implications for using multiple cellular technologies (for example, 4G LTE and 5G NR) in terms of licensing models and spectrum sharing.

Private networks are those owned and operated by a business or sector for their exclusive use and are not available for retail services to the public. Private networks feature network infrastructure that is used exclusively by devices authorised by the end user organisation. The roll-out of low-latency 5G networks and developing IoT use cases will lead to further integration of these technologies to create private networks. For example, overseas, several large manufacturers have licences to develop private networks.

Implications for New Zealand

Spectrum for International Mobile Telecommunications (IMT) has generally been made available on a nation-wide basis to ensure that a cell phone can receive and send data anywhere in the country. Private networks will create high demand in some IMT spectrum bands and may challenge this model. Making spectrum available for 5G or 6G across different bands (for example, 3.3 - 3.4 GHz and 3.8 - 4.2 GHz) has the potential to provide spectrum to industry sectors to develop private networks. Where there are multiple users in the same band, for example through private networks, interference management can become more complicated and administratively burdensome. Detailed technical criteria or rules may be needed to manage interference risks in some cases.

Different frequency bands are suitable for different use cases, so having spectrum available in high, mid and low frequency bands will allow for a variety of use cases and industry verticals. Significant investment in private infrastructure and the capability to build and operate these sorts of networks will be necessary. Agricultural and horticultural businesses for example, will likely need to source capability or services from existing operators or consulting firms.

The evolution of Radio Access Network (RAN) for cellular technologies including increased flexibility, decreased costs, RAN virtualisation and Open RAN may help drive increasing development and deployments of private networks and industry verticals. We are monitoring these developments.

A related issue is the role of licencing for such services which is currently restricted by the Radiocommunications Act 1989. This issue will be discussed further in section 4 of this outlook. RSM is also monitoring developments in spectrum sharing models including static, tiered and dynamic access mechanisms for 5G and other allocations (how they might be applied here).

Upcoming projects

- Consider 600 MHz, 1980 - 2010 MHz, 2170 - 2200 MHz, 3.34 - 3.4 GHz, 3.4 - 3.46 GHz, 3.8 - 4.2 GHz, 6.425 - 7.125 GHz, 24 - 30 GHz and 40 GHz frequency bands.

- Monitor 1427 - 1518 MHz.

- Develop and implement revised operational approach to small cell network licensing.

< 1. Our spectrum management framework | 3. Looking forward – Trends in spectrum management >